Are Financial Statements the Only Thing That Can Be Used to Calculate Financial Losses?

November 11, 2025

In these difficult times, the number of financial criminals is increasing. People are losing sight of sin and the afterlife. More and more people are willing to betray, harm their business partners, and even put their partners in danger simply for worldly greed and show-off behavior.

So, how can we prove financial losses if our business partners alter the company’s financial statements? Don’t worry, as long as you still have transaction records and supporting evidence such as access to bank statements, invoices, and/or contracts, these can prove the existence of the transactions.

——————————————————————————–

A Brief Summary of the Differences between SAK ETAP and SAK EP

October 6, 2025

SAK “Entitas Privat” (EP) is more comprehensive compared to SAK ETAP, but simpler when compared to PSAK. The following are the differences between SAK EP and SAK ETAP in brief: 1) SAK EP replaces the term “Balance Sheet” in SAK ETAP with “Statement of Financial Position”, 2) SAK EP replaces the term “Profit and Loss Statement” in SAK ETAP with “Comprehensive Income and Profit and Loss Statement”, 3) SAK EP provides a choice of cash flow statement presentation methods, the direct or indirect method. 4) SAK EP introduces and explains in detail the concept of undue cost or effort, while SAK ETAP only briefly explains the balance between costs and benefits, 5) SAK EP provides other options in the method of recording investments in associates and joint ventures, which are the cost method, fair value, or equity, 6) SAK EP provides several method options for measuring investment properties, using the cost or fair value model, 7) SAK EP regulates the requirements regarding the classification of financial instruments as liabilities or equity in more detail, the sale of options, rights and warrants, share capitalization, the issuance of bonus shares or stock splits, the termination of financial liabilities with equity instruments, as well as non-controlling interests and transactions in shares in consolidated subsidiaries.

——————————————————————————–

2024’s Corporate Social Responsibility (Christmas Sharing)

December 21, 2024

Time feels fast. Suddenly it was approaching Christmas and New Year again. On this occasion, Landis & Kadwell Indonesia is very happy to be able to share Christmas love with the people in the surrounding area. Hopefully this Christmas gift will be useful for those who receive it. God bless.

——————————————————————————–

Financial Reporting with Integrity

November 4, 2024

We would like to share again with all of you. And this time regarding the regulation of the Indonesian Financial Services Authority (“OJK”) regarding Banking, namely POJK no. 15 of 2024. The background to the formulation of this regulation is because fraud in financial reports has been proven to have an impact on the continuity of the Bank’s business, and the working paper from the Basel Committee on Banking Supervision (BCBS) shows that there is window dressing carried out by Global Systematically Important Banks.

Some important points of this regulation are: Obligation to carry out financial reporting processes with integrity; Prohibition of financial engineering for the Board of Directors, Board of Commissioners, Sharia Supervisory Board, and Executive Officers; Determination and implementation of internal control policies and procedures in the financial reporting process; and Formation of a special work unit.

——————————————————————————–

Overview of Merger for Listed Companies

October 9, 2024

A brief overview of business mergers for companies registered with the Indonesian Financial Services Authority (“OJK”) – Capital Market.

Here are the brief procedures: 1.) The board of directors of participating companies makes a business merger plan, 2.) The business merger plan is approved by the board of commissioners of each company, 3.) Announcement of a summary of the business merger plan to the public and employees, 4.) Submission of the business merger statement and supporting documents to the OJK, 5.) The business merger statement receives an effective statement from the OJK, 6.) The business merger receives approval from the General Meeting of Shareholders.

In the event that a business merger results in a material change in the nature of the financial condition of the company resulting from the business merger, then the entire impact of the change must be included in the business merger plan which includes a feasibility study, availability of experts, explanation of considerations for changes in business activities, explanation of the impact of changes in business activities on the company’s financial condition. If there is a change in controller, the business merger plan must include information on the prospective controller and brief information regarding management analysis and discussion of the companies participating in the business merger.

In this regard, the financial statements of companies participating in the merger must be audited for the last 2 years, and the last 3 years for non-listed companies. In the event that the last annual financial statement of the participating company has been more than 6 months old, the financial statement must be supplemented with an audited interim financial statement. Companies participating in the merger must submit a summary of financial data sourced from audited financial statements, information from audited proforma financial statements, and a summary of the independent appraiser’s report containing share valuation and fairness opinion. However, such data is not required to be submitted for mergers between the Company and 100% owned subsidiaries.

——————————————————————————–

Overview of Changes from SAK ETAP to SAK EP

September 10, 2024

Ready to implement SAK EP, guys?! The following is a brief overview of the changes from SAK ETAP to SAK EP.

Changes: Other comprehensive income is added to the comprehensive income statement, Cash flow statement has the option to use direct or indirect method, Investment in associates, Impairment of assets has a more complete and comprehensive regulations, Fixed assets have the option to use a revaluation model other than the cost model, Investment property has the option to use fair value, Leases are classified as finance and operating leases based on the old PSAK 30, Income tax includes current and deferred tax regulations, Income has a more comprehensive regulations like the old PSAK 23, Foreign exchange combines the two previous chapters (reporting currency and foreign currency transactions).

Additional Regulations: Consolidated and stand-alone financial statements, For financial instruments there are options for recognition and measurement using PSAK 55 or using Chapter 11 and 12, Business combinations and goodwill, Government grants, Share-based payments, Hyperinflation, Special activities: Agriculture, Mineral resources exploration and evaluation; Service concession agreements.

PSAK regulations that are not in SAK EP: Segments, Interim financial statements, Earnings per share, Fair value, Insurance contracts.

——————————————————————————–

Regulations that Microfinance Institutions Must Comply With

August 21, 2024

For all our friends who work in Microfinance Institutions, let’s comply with these Indonesian Financial Services Authority (“OJK”) regulations. There are 3 main regulations from OJK related to Microfinance Institutions (MFI), which are: POJK 10/POJK.05/2021, POJK 19/POJK.05/2021, and POJK 14/POJK.05/2014.

In general, what needs to be considered is: 1.) The maximum loan disbursement limit is set at a maximum of 10% of equity for one customer. For customers with a good track record and including credit guarantee collateral, the maximum limit is set at a maximum of 20%. 2.) The economic value of the collateral is at least 120% of the financing value. 3.) The Non-Performing Loan ratio must be maintained at a maximum of 10% and is prohibited from exceeding 30%. 4.) If the MFI has deposits and/or receives loans of more than IDR 200 million, the MFI is required to form an allowance for financial losses. If not more, may choose to form a reserve of 15% of net profit or remaining business results each calendar year based on the approval of the general meeting of shareholders. 5.) MFI is required to assess collateral to determine its economic value and have a place to store collateral that meets minimum standards of security and safety. 6.) MFI is prohibited from receiving loans except from Indonesian citizens and/or business entities established and operating in the territory of the Republic of Indonesia. 7.) MFI must maintain a level of risk that includes a liquidity ratio of at least 4% and a solvency ratio of at least 110%. 8.) MFI must maintain equity of at least 75% of paid-up capital, or 25% of paid-up capital for MFI that has a total amount of deposits and/or loans received with a maximum amount of IDR 200 million and form a reserve set aside from net profit or remaining business results each calendar year. 9.) Financial reports must be submitted periodically to the OJK every 4 months for the period ending on April 30, August 31, and December 31 and submitted no later than the end of the following month. 10.) Announce the financial report for the fiscal year through the notice board at the MFI office or local daily newspaper no later than 5 months after the fiscal year ends and proof of the announcement is submitted to the OJK no later than 20 working days after the announcement date.

——————————————————————————–

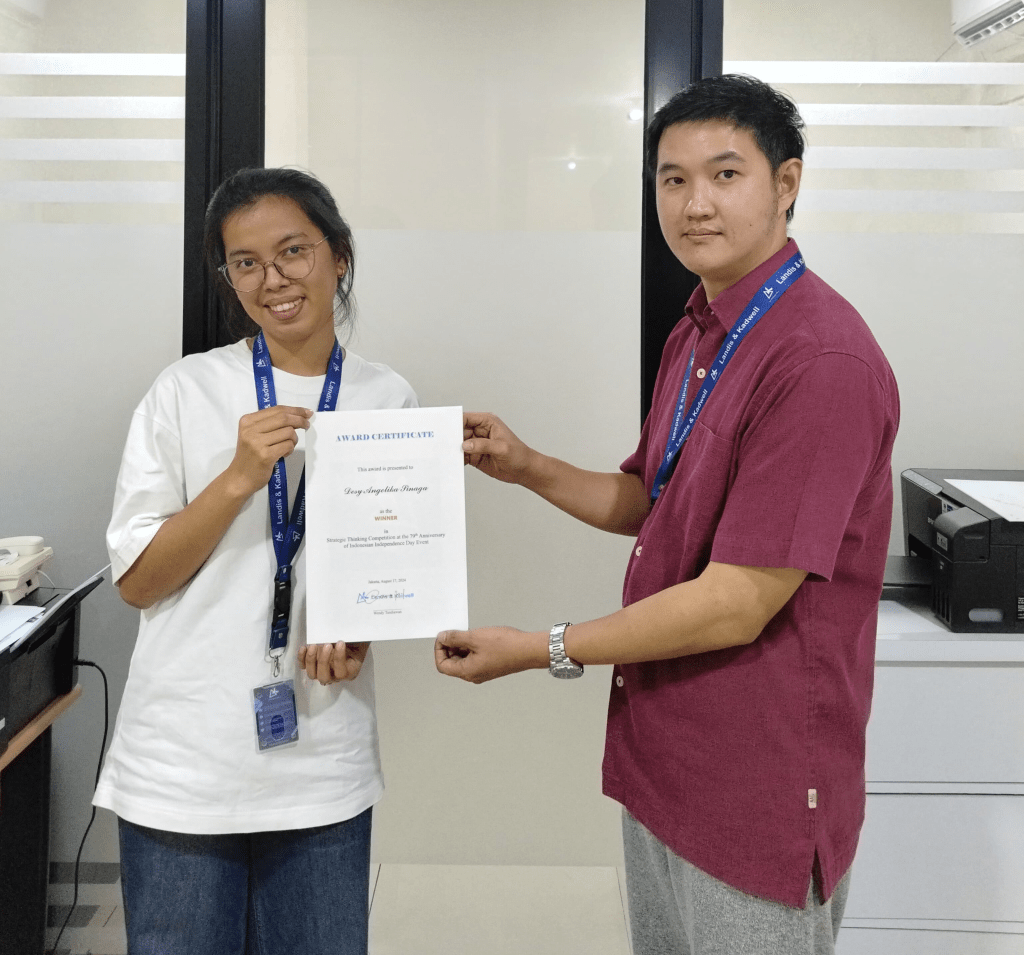

Commemorating Indonesian Independence Day

August 19, 2024

In order to commemorate Indonesia’s Independence Day, we are holding a competition with the theme “Strategic Thinking”. This competition combines logic, strategic thinking, and basic principles of professional ethics.

Congratulations to the winner of this competition, Desy Angelika Sinaga.

——————————————————————————–

Stoke Opname, One of Many Ways to Detect Financial Crime

January 29, 2024

The role of public accountants is increasingly needed in uncovering financial crimes. Recently there was embezzlement of funds carried out by a group of employees. The Company’s suspicions arose when the appointed public accountant discovered a difference in stock taking results between the actual stock amount in the warehouse and the stock amount in the system. In the end it was proven to be true that there were 13 people in the Company who worked together to sell goods without the Company’s approval in very small quantities on an ongoing basis, where the monthly difference was not material so it could not be discovered by the company’s internal audit team. After being carried out for 2 consecutive years, the Company’s losses reached tens of billions.

In this case, public accountants can help the company by providing testimony in court as an expert witness, as well as helping the company to calculate financial losses. Whether this testimony is accepted or not depends on the judge’s decision, the explanation of the prosecutor and the suspect’s lawyer.

——————————————————————————–

Employee Benefit Calculation

January 26, 2024

For entities that use “SAK ETAP”, apart from using the services of an actuary, you can calculate post-employment benefits yourself. Let’s make adjustments to the post-employment benefit obligations.

In general, post-employment benefits are the amount of compensation arising from two compensation components, severance pay and long service awards, each of which has a different year of service cap.

PSAK 24 requires an entity to attribute benefits to service periods based on a benefit plan formula from the date when the employee first earns benefits to the date when the employee will not earn a material amount of benefits. PSAK 24 stipulates that employee service before the vesting date gives rise to a constructive obligation with a maximum period of 24 consecutive years of service until retirement age. For example, if the retirement age is set at 56 years, then constructive obligations begin at age 32.

Not difficult, right? Let’s try it!

——————————————————————————–

Changes in the Method of Calculating Income Tax Article 21

January 9, 2024

The Indonesian government is taking important steps in making adjustments to the calculation of Income Tax Article 21 (“PPh 21”) in 2024. Through the issuance of Government Regulation (PP) no. 58 year 2023, the calculation of Income Tax Article 21 will use the calculation method based on an effective rate called “TER”. This update aims to provide convenience and simplicity in the technical calculation and administration.

In general, the annual calculation is the same as the previous calculation method. The difference is in the monthly calculation, which is by multiplying the gross income per month with an effective rate called “TER” which varies according to the amount of income per month. This calculation is carried out from January to November. In December, an adjustment calculation is carried out, which is by subtracting the annual calculation amount with the accumulated amount from January to November.

Let’s apply this new tax calculation!

——————————————————————————–

2023’s Corporate Social Responsibility (Christmas Sharing)

December 21, 2023

Time feels fast. Suddenly it was approaching Christmas and New Year again. On this occasion, Landis & Kadwell Indonesia is very happy to be able to share Christmas love with the people in the surrounding area. Hopefully this Christmas gift will be useful for those who receive it. God bless.

——————————————————————————–

Data Analytics and its Relationship with Management Information Systems

October 20, 2023

It is no longer a secret, data analytics is now one of the most crucial things in the world of accounting, especially management accounting. Skills in conducting data analytics can help in forming a good management information system. In one of the developing countries, Indonesia, many companies are currently competing to have good management information systems. They are willing to pay a lot for this! This is because these companies are starting to realize after seeing many success stories from many developed countries.

We all know that data accuracy is very important. A poor management information system can lead to wrong strategies which result in reduced effectiveness and efficiency. One example occurred in one of the largest palm oil mill companies in Indonesia. The management of the company sets a sales strategy and target based on data from the management information system which is then achieved. However, company management was confused and said that the cash obtained felt insufficient. At first, company management suspected fraud. After investigating, it turned out that the cause was poor information system management which was carried out semi-manually by less skilled people, where there was a miscalculation of the activity rate.

To get a good management information system, you need people who are experts in data analytics to validate the system, operate it as a functional user, and carry out continuous development.

——————————————————————————–

Knowledge Sharing with “Universitas Negeri Surabaya (UNESA)” in “Praktisi Mengajar” Program

July 3, 2023

It is another honor for us to be able to share knowledge with students from “Universitas Negeri Surabaya (UNESA”) in the “Praktisi Mengajar” program with the topic of Audit Practice and Audit Documentation based on “SPM 1”.

——————————————————————————–

Eurofragance Asia Pacific Pte Ltd Acquires 90% shares of PT Euronindo Fragance Internusa

July 2, 2023

As their deal support consultant, we are happy to announce the completion of the 90% share acquisition of one of the biggest perfume seed companies in Indonesia with a transaction value of appx. 2-3 equity book value by a Spain base company, Eurofragance Asia Pacific Pte Ltd which is one of the market leaders for perfume seeds in the world.

This deal is expected to have a positive impact on the development of the perfume industry in Indonesia as well as to give a transfer-knowledge to Indonesian human resources in the processing of perfume seeds.

——————————————————————————–

Placement of Funds at Commercial Banks for Export Proceeds of Natural Resources in Indonesia

July 1, 2023

A little sharing regarding placement of funds at Conventional Commercial Banks for Export Proceeds of Natural Resources in Indonesia. As we all know, natural resource exporters are required to set up a special account at a bank as an account for receiving foreign exchange proceeds from exports. Funds in this special account can be placed in: deposit, term deposit – conventional open market operations in foreign currency at Bank Indonesia (TD OMO FX BI), and/or other instruments stipulated by Bank Indonesia.

Recently, OJK issued letter no. S5/D 03 2023 which states that when an exporter (bank customer) chooses placement at TD OMO FX BI, bank passes funds to Bank Indonesia, and this activity in accordance with Law no. 10 year 1998 is closer to the definition of passing-by and not a deposit. Thus, the bank must reclassify the Third Party Fund into Other Liabilities and the bank should recognize the placement in TD OMO FX BI as Other Assets. Bank only recognizes fees received from TD OMO FX BI on a net basis in accordance with the value agreed between the bank and Bank Indonesia, and the interest income from TD OMO FX BI is directly pass-on to the customer’s account. Additionally, the income tax on deposit interest is final at the rate according to Government Regulation no. 123 year 2015.

As long as there is no risk exposure, placement in TD OMO FX BI does not have an impact on prudential treatment of: LCR, NSFR, Capital Ratios, Productive Asset Quality, and/or Maximum Credit Limit.

——————————————————————————–

Business Strategy – The Case Study of SUAVE

August 7, 2024

SUAVE is a shampoo and conditioner manufacturing company in the United States. In general, SUAVE is experiencing problems with its performance where sales continue to decline and its profit margin also continues to decline. Meanwhile, SUAVE has an old reliable brand and is a shampoo and conditioner manufacturer with the largest total unit sales.

Based on the analysis results, SUAVE has a decent total market share, sells products at low prices, has inelastic products, and is at the maturity stage. The recommended strategy is to increase advertising because SUAVE products are in a niche market and are at the maturity stage. One of the best places to advertise is through social media. Of course, rising from conditions at the maturity stage is not easy. One of the things SUAVE can do is to innovate the quality of its products which already have high brand loyalty.

——————————————————————————–

Knowledge Sharing with “Universitas Negeri Surabaya (UNESA)” in “Praktisi Mengajar” Program

April 3, 2023

It is a pleasure to be able to share knowledge with students from “Universitas Negeri Surabaya (UNESA)” in the “Praktisi Mengajar” program with the topic of Audit Practices.

Thanks to Bapak Made Dudy Satyawan for the opportunity. Wish UNESA and its students a continued success!

——————————————————————————–

The Effect of Financial Distress and Corporate Governance on the Discretionary Allowance for Impairment Losses

December 14, 2022

Since the enactment of IFRS 9 or PSAK 71 (in Indonesia), the calculation of allowance for impairment losses (especially on the probability of default) has become more complicated. This complexity creates an opportunity for companies to exercise discretion, which of course for a specific purpose/interest.

In this regard, a bank is a company that has the largest recognition of allowance for impairment losses due to the size of its financial assets.

According to theory, the two main things that can affect discretionary accrual (of which the allowance for impairment losses plays a very important role) are financial distress and corporate governance. Does this theory apply to all companies in any country? It turns out that this theory does not apply to all companies. In the banking industry in Indonesia, for example, financial distress and corporate governance (except for managerial ownership) have no effect on the discretionary allowance for impairment losses.. Nonetheless, there appears to be a possibility that greater managerial ownership can increase the level of managerial discretion.

Tandiawan, W. (2022). The Effect of Financial Distress and Corporate Governance on the Discretionary Allowance for Impairment Losses . Studi Akuntansi, Keuangan, Dan Manajemen, 2(2), 99–111

——————————————————————————–

Business Perfomance Evaluation of a Recreation Company in Indonesia Using Balanced Scorecard

November 11, 2022

Have you ever imagined that a big company that dominates an industry could be dimmed and almost never heard of again? There is one big recreation company in Indonesia that has been around for decades, whose name is now rarely heard. How is the current condition of the company, is it still profitable, and how is the company’s business now?

One tool that is good enough to be used to answer this question is the Balanced Scorecard (BSC) analysis, where the strategy map objectives for each perspective can be determined based on the results of the BSC-SWOT matrix analysis.

Tandiawan, W. (2022). Business Perfomance Evaluation of a Recreation Company in Indonesia Using Balanced Scorecard. Jurnal Akuntansi, Keuangan, Dan Manajemen, 3(4), 359–373

——————————————————————————–

This is The Role of Public Accountants in Detecting Financial Crimes

October 31, 2022

The public accountant profession does not only play a role in financial auditing, but also in detecting financial crimes.

“If investigators do not find enough evidence on the elements of a criminal act of corruption, but there is a real financial loss, then the public accountant will then carry out the investigation,” said Partner of Landis & Kadwell Indonesia, Indra Tirta Kusuma who is also a practitioner in the legal field.

This is stated in Law Number 31 of 1999 concerning Eradication of Corruption Crimes, as amended by Law Number 20 of 2001 concerning Amendments to Law Number 31 of 1999 concerning Eradication of Corruption Crimes (“Corruption Law”).

Indra added that the services provided by public accountants in this regard are called investigation services, which can be divided into investigative examination, calculation of financial losses, and providing expert information.

Meanwhile, Teddy Kho who is also a Partner of Landis & Kadwell Indonesia said that public accountants need to have special skills to be able to provide investigative services.

“In practice, when calculating the financial losses and providing expert information, law enforcement officers often ask to show the evidence of competence such as certificates stating expertise in the field of investigation,” he explained.

Meanwhile, there is one method for public accountants to be able to have investigative skills. It is by participating in the trainings and becoming a Certified Professional Investigator (CPI) issued by a credible public accountants institution, the Indonesian Institute of Certified Public Accountants (“IAPI”).

Landis & Kadwell Indonesia partner, Wendy Tandiawan said that with the issuance of the investigative service standard by IAPI, it made it clearer the types of assignments carried out by public accountants.

Whereas previously, the assignment of investigation services was often assumed to be a part of agreed upon procedure engagement, now it already has its own standard. And thus, it can use the investigation service engagement.

“IAPI is committed to continuing to develop these investigation service standard, which will later provide a complete framework and methodology for public accountants to carry out investigation services,” he said.

——————————————————————————–

Landis & Kadwell Indonesia Encourages The Implementation of SAK EP

October 25, 2022

Landis & Kadwell Indonesia encourages the application of Accounting Standard for Private Entity (“SAK EP”) in the preparation of financial reports and audits. This is due to the Indonesian Accounting Association (IAI) announced the change of Accounting Standard for Entities Without Public Accountability (“SAK ETAP”) to “SAK EP” which will be effective on January 1, 2025.

One of the partners from Landis & Kadwell Indra Tirta Kusuma said that many companies in Indonesia chose to use SAK ETAP in preparing financial reports and audits because it was simpler, which was then used for general purpose financial statements for external users such as: owners who are not directly involved in business management, creditors and credit rating agencies.

“This will be a new challenge for entities and auditors in Indonesia to start studying the application of SAK EP. Broadly speaking, SAK EP begins to refer to PSAK but there are some exceptions,” he said.

Meanwhile, Landis & Kadwell Partner Wendy Tandiawan said that there are important differences that need to be considered between SAK EP and SAK ETAP.

He said, if in SAK ETAP companies are allowed to use a simpler method (such as the cost model) for the initial cost measurement of several types of company assets (such as investment properties, defined benefit obligations, biological assets, investments in subsidiaries, preferred and common stock investment, intangible assets, and equity instruments), in SAK EP, they are required to use the method required by PSAK, measure fair value reliably.

“However, it is allowed to give exceptions not to include undue cost or effort,” he explained. Furthermore, he added that entities are also required to disclose the reasons for the exceptions.

Partner of Landis & Ladwell Teddy Kho explained areas that need to be considered in changing SAK ETAP to SAK EP which includes: financial statements, basic and other financial instruments, business combinations and goodwill, government grants, share-based payments, asset value impairment, hyperinflation, special activities (such as: agriculture, exploration and evaluation of mineral resources, and service concession agreements), property, plant and equipment, intangible assets, investment properties, other comprehensive income, and deferred tax recognition.

——————————————————————————–

Audit Practice

October 7, 2022

A sharing from Bapak Christian Ferdinand,

Audit is an examination conducted by an independent party critically and systematically on the financial statements, financial records, and supporting evidence prepared by members of the company’s management in order to provide an opinion on the feasibility of a financial report.

The purpose of the audit is to assess the fairness or appropriateness of the presentation of the financial statements prepared by the company. The feasibility and fairness refers to financial accounting standards and subsequently the assessment will be reflected in the audit opinion.

After completing the audit process, the auditor is required to provide an opinion. Broadly speaking, there are two (2) types of opinion, namely Unmodified Opinion and Modified Opinion.

The auditor shall express an Unmodified Opinion if the auditor concludes that the financial statements are prepared in all material respects in accordance with applicable financial reporting. If the auditor concludes that based on the audit evidence obtained, the financial statements as a whole are not free from material misstatement, and the auditor does not obtain sufficient appropriate audit evidence to conclude that the financial statements are free from material misstatement, the auditor may provide a Modified Opinion, which includes:

Qualified Opinion: This opinion is expressed when the auditor, after obtaining sufficient appropriate audit evidence, concludes that the misstatements, taken as a whole, are material, but do not affect the financial statements as a whole. In addition, a qualified opinion may be issued when the auditor is unable to obtain sufficient appropriate audit evidence, but the auditor concludes that the possible impact of an undetected presentation could be material but not material to the financial statements.

Adverse Opinion: The auditor should express an adverse opinion when the auditor, after obtaining sufficient appropriate audit evidence, concludes that the misstatement of the financial statements is material and affects the financial statements as a whole.

Disclaimer of Opinion: The auditor shall not express an opinion when the auditor is unable to obtain sufficient appropriate audit evidence on which to base the opinion, and the auditor concludes that the possible effects of an undetected misstatement could be material and affect the financial statements as a whole.

Below is a summary of changes to the Audit Opinion Sheet which will take effect in early 2023:

In general, the audit stages include: engagement, planning, execution, and reporting; all of which must refer to the Quality Control Standards (“SPM 1”)

At the engagement stage, there are usually: engagement letters, analysis of acceptance and continuity of relationships with clients, checking of conflicts of interest and risk assessment, determination of budget hours, assignment letters, statements of independence, and communication with the engagement team.

At the planning stage, usually there are: calculation of audit materiality, calculation of audit risk (Risk Material Misstatement), determination of audit procedures, preparation of working papers, understanding of entities and the environment, and analytical review.

At the implementation stage, the auditor will usually perform: gathering audit evidence, tests of controls, substantive tests, compliance with audit procedures, and completing working papers.

At the reporting stage, the auditor will usually prepare and submit: a management letter, and independent auditor’s report accompanied by an audit opinion, and a representation letter.

Nevertheless, the engagement letter also needs to include the following: an explanation of the scope of the audit, the form of communication to be used by the auditor, an explanation of the fact that with the inherent limitations of an audit together with internal control, there are unavoidable risks about the possibility non-detection of some material misstatements, composition of the audit team, expectation that management will provide written representations, agreement that management will cooperate and provide data in a timely manner, an agreement that management will provide the auditor with information about facts known to management, the determination of fees and their collection arrangements, and a request for management to agree to the terms of the engagement and sign them

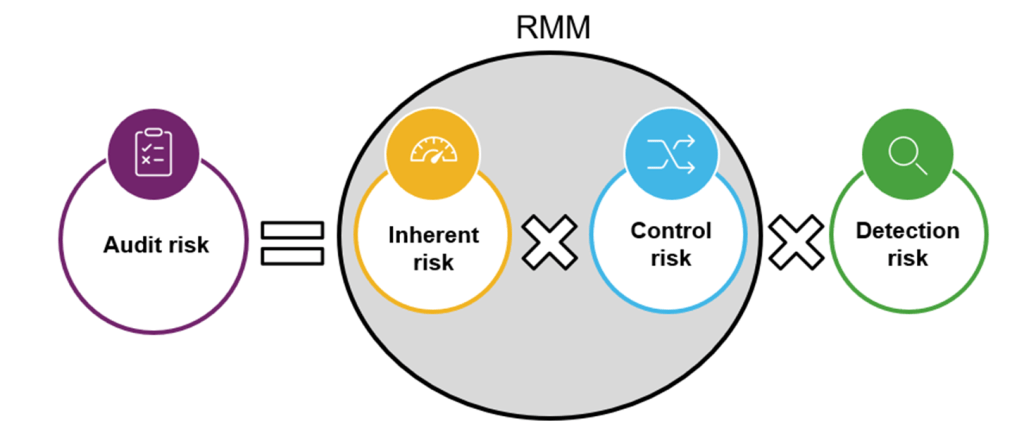

Below is the formulation of audit risk:

Risk of Material Misstatement consists of: Inherent Risk which is the company’s adaptation to the business environment, Complexity of recording and transaction activities, Integrity of management and employees, previous audits, and related party transactions; and Control Risk, which includes Segregation of Duties, document and transaction verification process, supplier selection process, and management involvement in document approval.

After obtaining the Risk of Material Misstatement, usually the auditor will determine the amount of Detection Risk to obtain the appropriate Audit Risk. In general, factors that can determine the amount of Detection Risk include: team composition, audit procedures, and quality control.

In accordance with the auditing standard “SA 320”, there are several things that need to be considered in determining audit materiality, namely: requiring professional judgment, is relative (not absolute), determined at the planning and implementation stage of the audit, is cumulative (not separate/separately), the amount/value is not determined by the Auditing Standards, and may change along with the progress of the audit.

Factors in considering the basis (benchmark) for determining materiality: elements of financial statements (eg assets, liabilities, equity, income, expenses); whether there are elements that are of particular concern to users of the financial statements of a particular entity (for example: for the purpose of evaluating financial performance, users of financial statements tend to focus on profit, income or net assets); the nature of the entity, the entity’s position in its life cycle, and the industry and economic environment in which the entity operates; and The entity’s ownership and financing structure (for example, if an entity is financed solely from debt and not from equity, users of financial statements will place more emphasis on assets and claims on those assets than on the entity’s income).

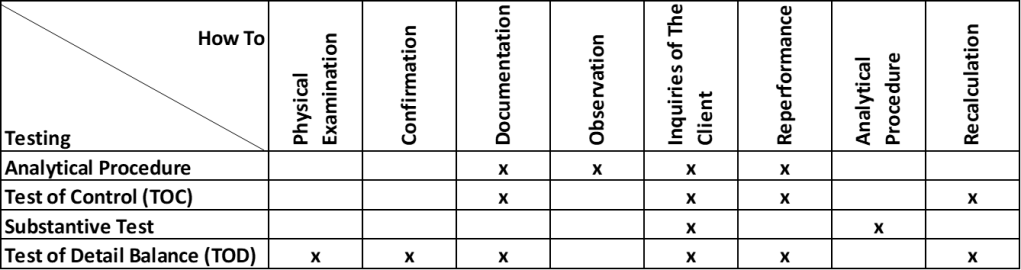

Below are the types of tests in the audit implementation stage:

The types of audit evidence that may be collected by the auditor include: Physical Evidence, Documentation Evidence, Calculation Evidence, Oral Evidence, Confirmation Evidence, Analytical Evidence, Observational Evidence, Specialist Evidence, Statement Evidence, and Benchmark Evidence.

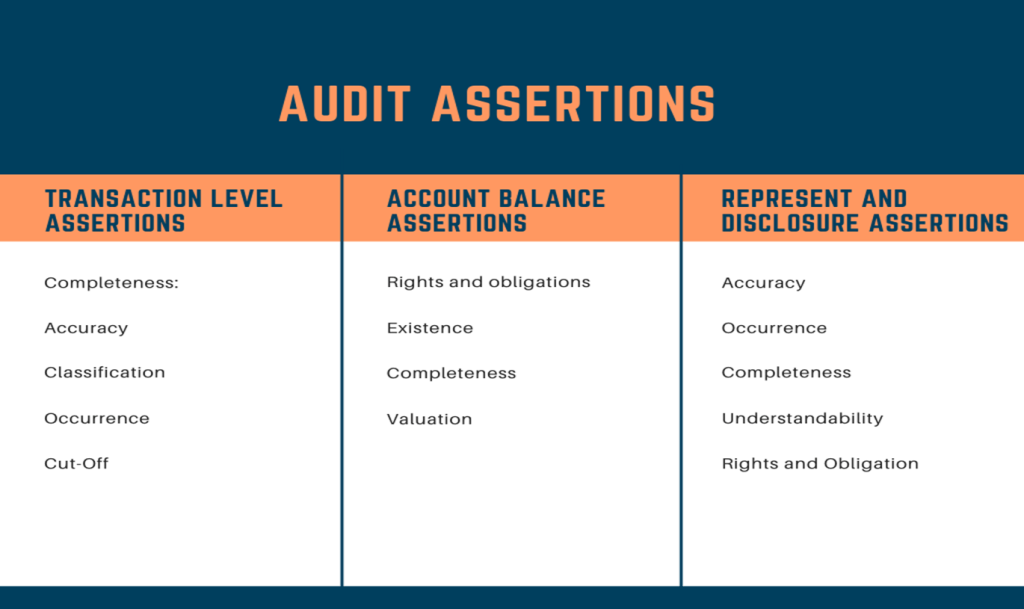

In conducting audits and/or audit procedures, it is necessary to pay attention to audit assertions which are divided into 3 parts: transactions, balances, and presentation/disclosures.

In the transaction section, includes:

Occurrence — the transactions recorded have actually taken place.

Completeness — all transactions that should have been recorded have been recorded.

Accuracy — the transactions were recorded at the appropriate amounts.

Cutoff — the transactions have been recorded in the correct accounting period.

Classification — the transactions have been recorded in the appropriate caption.

In the balance section, includes:

Existence — assets, liabilities and equity balances exist.

Rights and Obligations — the entity legally controls rights to its assets and its liabilities faithfully represent its obligations.

Completeness — all balances that should have been recorded have been recorded.

Valuation and Allocation — balances that are included in the financial statements are appropriately valued and allocation adjustments are appropriately recorded.

In the presentation/disclosure section, it includes:

Occurrence — the transactions and disclosures have actually occurred.

Rights and Obligations — the transactions and disclosures pertain to the entity.

Completeness — all disclosures have been included in the financial statements.

Classification — financial statements are clear and appropriately presented.

Accuracy and Valuation — information is disclosed at the appropriate amounts.

Of course, in conducting an audit, it must refer to the standards that apply in Indonesia, namely the Professional Standards of Public Accountants (“SPAP”) and Financial Accounting Standards (“SAK”).

There are four (4) types of Financial Accounting Standards applicable in Indonesia, which include:

“PSAK” -> converges with International Financial Reporting Standard (IFRS) -> Fair Value Basis + Adequate Financial Information

“SAK ETAP” (which will change to “SAK EP” and come into effect in early 2025) -> Intended for use by Entities Without Public Accountability (“ETAP”), namely entities that do not have significant public accountability and issue general purpose financial statements (general purpose financial statements) for external users (eg owners who are not directly involved in business management, creditors and credit rating agency) -> Historical Basis with Fair Value Option + Sufficient Financial Information

“SAK EMKM” -> Can be used by entities that meet the definition of an entity without significant public accountability as stipulated in “SAK ETAP” and the characteristics in Law No. 20 of 2008 concerning Micro, Small and Medium Enterprises (MSME) -> Historically Basis + Simple Financial Information

“SAK SAS” -> based on general accounting concepts that have been adapted to sharia principles. This concept is reflected in the Basic Framework for the Preparation and Presentation of Islamic Financial Statements (“KDPPLKS”)

After completing the audit process, usually the auditor will summarize the management letter. Management letter is a letter made by a Public Accounting Firm (“KAP”) addressed to the management of a company or client (auditee) whose financial statements have been examined. Contains the conclusions of the public accountant regarding the company’s accounting policies and procedures, internal controls, and operational policies, accompanied by suggestions for improvement from the Public Accounting Firm.

Prior to the issuance of the audit report, the auditor will request a representation letter from the client. A management representation letter is a letter addressed to the auditor, signed by the client’s management. The written representation from management is an affirmation that the information and/or data provided to the auditor is true.

——————————————————————————–

Corporate Social Responsibility (CSR) and Access to Funding

October 7, 2022

Is it true that Corporate Social Responsibility (CSR) affects access to funding? According to several studies abroad, it can be concluded that good CSR can reduce funding constraints. How about in Indonesia?

Based on the results of the study, it can be concluded that CSR has no effect on access to funding in Indonesia. This may be due to the fact that the implementation of CSR has not received serious attention from the Government and has not been closely monitored. However, there is one thing that affects the access to funding in Indonesia, which is Stakeholder Engagement. Stakeholder Engagement based on mutual trust and cooperation reduces potential agency costs by pushing managers to adopt a long-term rather than a short-term orientation. Moreover, superior Stakeholder Engagement enhances the revenue or profit generating potential of the firm through the higher quality of relationships with customers, business partners and among employees.

Tandiawan, W. (2022). Tanggung Jawab Sosial Perusahaan dan Akses Pendanaan. Jurnal Akuntansi, Keuangan, Dan Manajemen, 3(4), 323–341

——————————————————————————–

Certified Professional Investigator and Its Role in Corruption and Financial Crimes

October 4, 2022

It is an honor to our Partners, Bapak Teddy Kho and Bapak Wendy Tandiawan to be able to take and pass the Certified Professional Investigator (CPI) exam held by the Indonesian Institute of Certified Public Accountant (“IAPI”).

The training provided to the examinees was very good, presenting experienced experts in the field of investigation, such as ad-hoc judges of the Supreme Court, former deputy chairman of the Corruption Eradication Commission, phenomenal corruption eradication figure, Bapak Novel Baswedan, and many more.

In the future, public accountants are expected to be able to further assist people in resolving financial cases by providing investigative examination services and/or becoming expert witnesses. In accordance with Indonesian Law no. 31 of 1999 concerning the Eradication of Corruption Crimes, public accountants also have the authority to calculate financial losses. These are all part of other assurance services as stated in Indonesian Law No. 5 of 2011 concerning Public Accountants.

Bravo IAPI!

——————————————————————————–

Knowledge Sharing with “Universitas Lambung Mangkurat (ULM)” in “Praktisi Mengajar” Program

September 1, 2022

It is a pleasure to be able to share knowledge with students from “Universitas Lambung Mangkurat (ULM)” in the “Praktisi Mengajar” program with the topic of Audit Practices.

Thanks to Professor Hesty and Ibu Mellani Yuliastina for the opportunity. Wish ULM and its students a continued success!

——————————————————————————–

Accounting Firm (“KAP”) “Tandiawan dan Rekan” joins Landis & Kadwell Global Network

August 24, 2022

The Accounting Firm (“KAP”) “Tandiawan dan Rekan” announced that it has officially joined the global network of Landis & Kadwell.

Teddy Kho as Partner of KAP Tandiawan dan Rekan said that the purpose of this join was to strengthen audit and financial consulting services in Indonesia.

Teddy added that the Accounting Standard currently applicable in Indonesia, “Pernyataan Standar Akuntansi Keuangan”(“PSAK”) adopts an international standard called the International Financial Reporting Standard (IFRS).

“Therefore, we as auditors and financial consultants, need to be affiliated with a network of foreign consultants to be able to further increase our knowledge,” he said.

Indra Tirta Kusuma, who is also a Partner of KAP Tandiawan dan Rekan, added that currently there are more and more companies that require audit services from foreign affiliated auditors. This is because more and more foreign investors are entering Indonesia.

“In addition, State-Owned Enterprises (BUMN) also require that every accounting firm that conduct the audit service must have foreign affiliation where the audit process is expected to use implementation methodologies that have been recognized and implemented globally,” he explained.

Meanwhile, KAP Tandiawan dan Rekan’s Partner, Wendy Tandiawan said, “Landis & Kadwell has a vision that is in line with ours, which is to provide quality integrated services by prioritizing comfort, stability and efficiency. In addition, Landis & Kadwell also provides similar services, which include external audit, taxation, and financial advisory.”

“Thus, joining Landis & Kadwell is expected to provide good synergy,” he said.

https://mediaindonesia.com/ekonomi/532867/kap-tandiawan-dan-rekan-bergabung-dengan-landis-kadwell

——————————————————————————–

Indonesian Tax Voluntary Disclosure Program

June 1, 2022

Hi my Indonesian friends, have any of you ever received a letter of request for clarification (“SP2DK”) from the Tax Office stating that the amount of additional assets during 2016 to 2020 did not match the amount of income reported on Tax Return? If the number of difference is huge and you are not willing to make corrections, pay “PPS” a.s.a.p. There is still time until June 30, 2022. The rate is 14% for domestic assets.

Currently the government is planning to eliminate Tax ID (“NPWP”) and replace it with Citizen ID Card No. (“NIK”) which will take effect in early 2023. This will open wider access for Tax Officers to track transactions. Therefore, let’s pay taxes according to the income we receive, and prepare tax planning if needed.

——————————————————————————–

Going Concern Assessment During Covid-19 Pandemic

February 24, 2022

How are you, company management? Have you updated the going concern assessment in your company during the COVID-19 pandemic?

In accordance with SA 570, the auditor has the responsibility to obtain sufficient appropriate audit evidence about the appropriateness of management’s use of the going concern basis of accounting in the preparation of the financial statements, and to conclude whether there is a material uncertainty about the entity’s ability to continue as a going concern. There are 3 things to note: First, the use of the going concern basis of accounting must be appropriate, disclose all things that can affect the company’s going concern, both subsequent events and after. Second, check whether there is material uncertainty. During this pandemic, companies can make or update their financial statements projection, especially in the sensitivity section, by adding a downside scenario in case of additional lockdown. Check the liquidity ratio and working capital requirements, and make sure to include all covenants in the projection. Third, if there is significant doubt, management should be willing to make or extend its assessment by preparing a plan to mitigate so that bad scenarios can be resolved. In addition, it is also necessary to pay attention to the latest regulations from the government related to the Covid-19 pandemic.

——————————————————————————–

Economic Stimulus for Indonesian Rural Banks (“BPR”) in Facing COVID-19 and Preparations for Welcoming SAK EP

August 27, 2021

How are you Indonesian Rural Bankers? Have you implemented the economic stimulus for COVID-19? During the turmoil of the COVID-19 pandemic in Indonesia, the government has provided a stimulus for all banks since 2020 with the issuance of “OJK” Regulation No.11/POJK.03/2020, updated to “OJK” Regulation No.48/POJK.03/2020 which includes the following: loan disbursement of < IDR 10 bio can be analyzed only by looking at the historical ability to service the debt, granting new loan to debtors can be done separately regardless of the quality of the previous loan, and restructuring can be carried out for all types of loan regardless of the borrowing limit and type of loan. The quality of the restructured loan can also be determined as “Current” if the debtor is affected by COVID-19. Nevertheless, Banks must also apply risk management in implementing this stimulus which includes: preparing guidelines to determine which debtors are affected by COVID-19, evaluating which debtors can survive, recording allowance for debtors who are considered unable to survive, overseeing the capital adequacy as well as the additional expected loss allowance for anticipation, and checking the bank soundness periodically.

The government provided additional stimulus for Rural Banks (“BPR”) with the issuance of “OJK” Regulation No.34/POJK.03/2020, updated to “OJK” Regulation No.2/POJK.03/2021. This is because the Rural Banks main target market is the MSME sector. In this case, Rural Banks may: use a general “PPAP” of less than 0.5% for current quality productive assets, use the percentage of foreclosed assets as a tier I capital deduction factor in the calculation of CAR, ignore the maximum limit for inter-bank placements to overcome liquidity problems, reduce the training cost to less than 5% of the previous year Human Resource costs realization, and ensure that the distribution of dividends or ”tantiem” does not have any impact on capital adequacy. In connection with this, Rural Banks are required to simulate the impact of implementing the stimulus on the capital adequacy.

Apart from all that, Rural Banks that are still using “SAK ETAP” need to make preparations to welcome the new “SAK EP” which will be effective in 2025. The most important thing is the change in the calculation of the allowance for impairment losses which currently uses the “PPAP” policy will be required to use the calculation in accordance with PSAK 55 (adopted from IAS 39).

Let’s apply this economic stimulus and start updating your allowance for impairment losses system!

——————————————————————————–

Outsourced Accounting vs In-House Accountant

July 1, 2021

How are you, business owners? Have you ever thought about using outsourced accounting service? Why many people nowadays prefer to use outsourced accounting service rather than using in-house accountants? Don’t you want to know the answer? It is because:

Outsourced accounting services often provide higher quality and expertise. Employees of outsourced services are usually experts who undergo continual training in accounting and technology. Many Micro, Small and Medium scale companies do not even provide training for their accountants due to cost issues.

Outsourcing helps reduce the risk of fraud. By using outsourced accounting services there will be a separation of duties and ore rigorous steps taken when preparing the financial statements.

Outsourcing your accounting can help alleviate late, inaccurate or meaningless financial reporting. Financial reporting will be on time and accurate when outsourcing because employees are trained, experienced and only focus on their core job descriptions.

Cost difference between In-House and Outsourced accounting. The cost of using an in-house accountant is certainly more expensive than using outsourced accounting services. This is because in-house accountants work for a full-time and there are additional costs such as: Medical Allowances, Retirement Plans, THR Allowances, Leave Allowances, Overtime Allowances, Training Fees, and others. And of course there are severance costs if the employee is dismissed or has entered retirement period. Moreover, during a pandemic like this, the costs for in-house accountants continue to run even though they work at home.

——————————————————————————–

Cryptocurrency Accounting Treatment

June 8, 2021

Have you ever thought about how the accounting treatment for Cryptocurrency is? Is Cryptocurrency a Cash, Financial Asset, Inventory, or Intangible Asset? It seems inappropriate to recognize Cryptocurrency as Cash, because they cannot readily be exchanged for any good or service as defined in PSAK 2/IAS 7. What about Financial Asset? It doesn’t seem right either, because Cryptocurrency is not a debt security, nor an equity security. It does not represent an ownership interest in an entity as defined in PSAK 71/IFRS 9.

According to the International Financial Reporting Interpretations Committee (IFRIC), Cryptocurrency can be recognized as Inventory (FV less cost to sell) if it is held for trading; and as an Intangible Asset (Revaluation “or” Cost Model) if it is for other purposes. Most Cryptocurrencies have an indefinite useful life so there is no need to calculate any amortization.

Then how is the accounting treatment for Cryptocurrency Miners? Of course this is not a part of PSAK 72/IFRS 15 because there are no contracts, and the rewards are not paid by any counterparty, but through a system algorithm. In this case, the Conceptual Framework can be a reference. The obtained reward can be recorded as (Dr) Intangible Asset “or” Inventory, (Cr) Income in P/L.

——————————————————————————–

Appropriate Recording of Rental Transactions

May 11, 2021

How do you record lease transactions in your company? Have you implemented PSAK 73 (adopted from IFRS 16, replacing PSAK 30)? If you record all rental transactions as Rental Expenses, then there is a possibility that you have not applied PSAK 73. Let’s get to know the concept of it.

According to PSAK 73, every contract that contains a lease must be tested whether it is a Right of Use Asset or an Operating Lease. There are 2 main things that need to be considered: 1) Is the leased asset a low value asset? In this case there is no standard rule for calculating the materiality limit for low value asset and usually companies use the amount of USD 5,000; 2) Is the contract period “more than” 12 months? The company must recognize the Right of Use Asset if all of the two criteria above are met. In presenting the Right of Use Asset, companies must first calculate the amount of lease liability using the present value principle. The present value is discounted using an implicit interest rate or an incremental interest rate (if the implicit interest rate cannot be determined).

Try to re-check your rental contracts again. If you need a sample procedure of PSAK 73, please request to us! It’s free.

——————————————————————————–

What is POCI?

May 10, 2021

Let’s be aware of “Purchased or Originated Credit Impaired (POCI)” transactions. POCI is a receivable that is already impaired at the time when it is purchased or originated. An example of it is the purchase of a Non Performing Loan (NPL). If there is a transaction like this, how do you record it?

It should be noted that the recording of POCI is different from the financial instrument transactions in general. The initial recognition of POCI is based on the purchase price and after that it is necessary to recalculate the Expected Credit Loss (ECL) by making an expected cash flow and put in the LGD component using the collateral shortfall method. If the POCI purchase price is lower than the recalculated net book value, it is not necessary to provide the allowance for impairment losses; vice versa. What if the company receives cash from the collection and/or collateral sales? It should be recorded as a deduction of the purchase price of POCI. If the company receives more than the POCI’s purchase price, the excess should be recorded as income in the P/L Statement.

Let’s get to know POCI together even more!

——————————————————————————–

PSAK 71, Is It Complicated?

May 10, 2021

Does the company you work for hold a financial instrument? Let’s get to know what a financial instrument is. Financial instrument is a contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity. Therefore, if your company has such contract(s), it is necessary to consider whether they are financial instruments or not.

According to the Indonesian accounting standard, PSAK 71 (adopted from IFRS 9; replacing PSAK 50, 55 & 60), every financial instrument must be tested with SPPI and Business Model Test and classified into the appropriate category. Furthermore, Any financial instruments that are categorized other than Fair Value Through Profit/Loss must be presented along with the allowance for impairment losses based on the principle of Expected Credit Loss (ECL) which is divided into 3 stages plus the Forward Looking scenarios. There are many statistical models that can be used to calculate the Probability of Default of the ECL, such as: Cohort, Markov Chain, and so on. All of which have a similarity. They calculate possible credit losses based on the current and historical data of the instrument and/or the similar instrument(s).

If you need a sample procedure of PSAK 71, please request to us! It’s free.

——————————————————————————–

Prepare Yourself for The Implementation of SAK EP

May 5, 2021

A little sharing, currently there are 3 accounting standards that apply in Indonesia outside of the standard for Sharia, namely: SAK, SAK ETAP, and SAK EMKM. Beside SAK, Indonesian Institute of Accountants (IAI) allows entities in Indonesia to apply a simpler accounting standard by enacting SAK ETAP for entities with no significant public accountability and SAK EMKM for micro, small and medium enterprises.

Recently, IAI announced to replace SAK ETAP with SAK EP. This new accounting standard is planned to be effective starting January 1, 2025 and is allowed for early implementation starting January 1, 2022. Thus, this will be a new challenge for entities and auditors in Indonesia to start learning the implementation of SAK EP. Broadly speaking, the SAK EP (Draft) provides an option to use the fair value principle; and there is a change in the recognition, measurement, presentation and disclosure of several accounts. The new standard also requires presenting comprehensive profit/loss, attributable comprehensive income in the statement of equity changes, and providing an option to use the direct method in the operating cash flow statement.

Let’s start applying SAK EP!